Sanchay Plus - Features & Benefits

Highlights of Plan

- ✅ Assured returns with zero market risk - no surprises, just guaranteed growth.”

- 💼 Plan your future confidently with 100% tax-free* maturity or income benefits.

- 💰 Choose how you want to receive money - one-time or lifelong income stream.

- 🛡️ Life cover + savings = your family's financial safety and your peace of mind.

- 😊 Return of premiums available in income options - your capital stays safe while you earn.

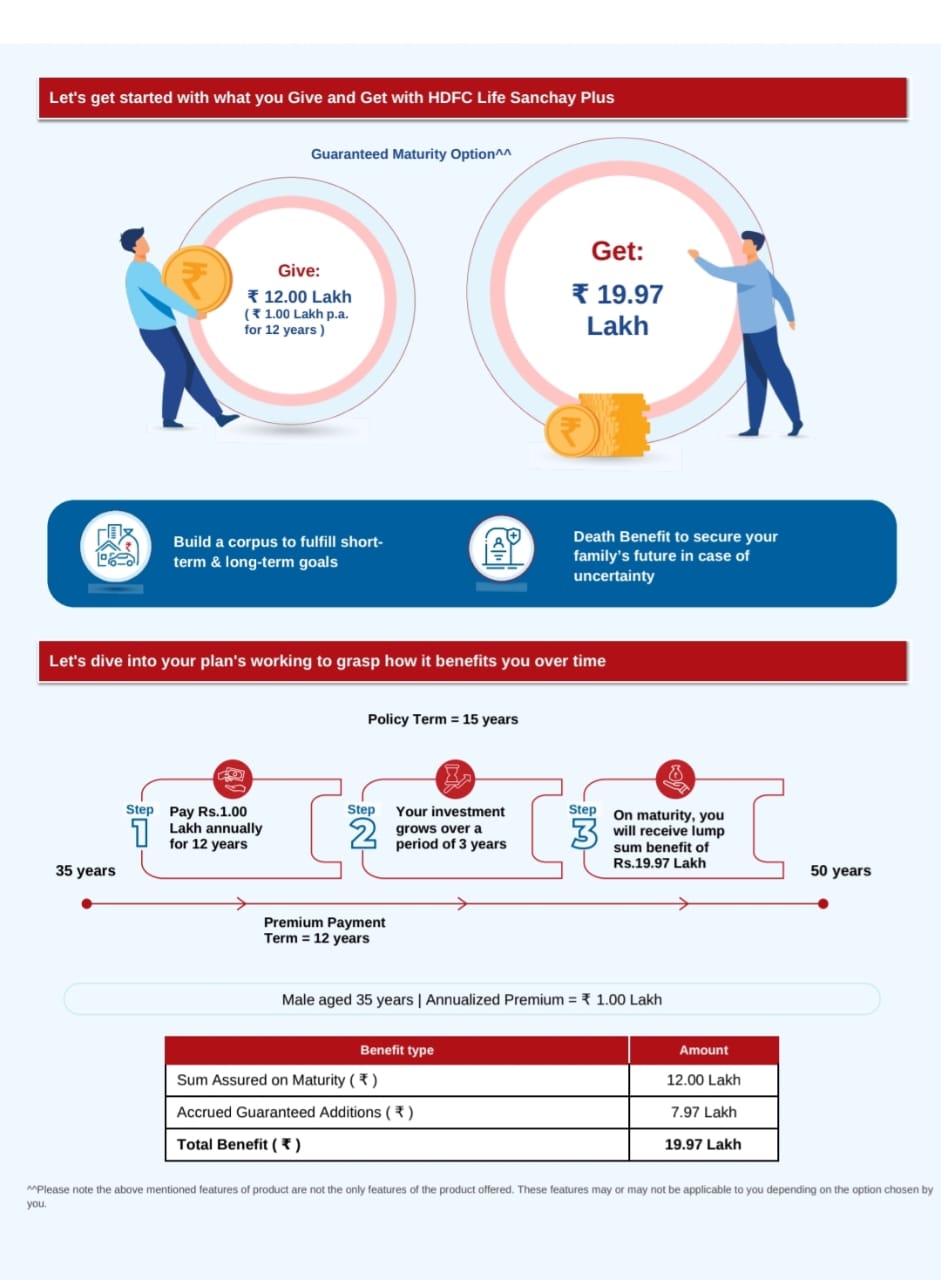

Guaranteed Maturity

Key Features: One-time lump sum payout at maturity. - Guaranteed Additions accrue post premium payment term. - Ideal for planned future expenses (education, marriage, etc.).

Attractive Line: Get a lump sum payout with guaranteed additions - perfect for planned goals like education or marriage!

Guaranteed Income

Key Features: Receive fixed annual income for 10 to 12 years post maturity. - Total income ranges from 179% to 209% of annual premium. - Option to receive future payouts as a discounted lump sum.

Attractive Line: Enjoy fixed yearly income post-maturity – just like your salary, but guaranteed and tax-friendly!

Life Long Income

Key Features: Guaranteed income until age 99. - Return of all premiums at the end of payout period. - Suitable for long-term financial stability or retirement income.

Attractive Line: Lifetime income till age 99 – your pension-like solution with premium return assurance!

Long Term Income

Key Features: Guaranteed income for 25 to 30 years. - Return of all premiums at end of payout period. - Enhanced income percentages based on premium and term.

Attractive Line: A long-term money-back plan for your second innings – income up to 30 years + premium return!

Real Claim Stories

Insurance is the subject matter of solicitation. For more details on risk factors, associated terms and conditions and exclusions please read sales brochure carefully before concluding a sale.

© Copyright 2026 beingcovered.com. All Rights Reserved.